capital gains tax increase effective date

Key Points House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. With average state taxes and a 38 federal.

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Iii From a top individual rate of 882 to rates ranging from 965 to 109.

. Democrats compromise on a prospective effective date of Jan. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that. Capital gains tax increase effective date Saturday June 18 2022 The proposal would increase the maximum stated capital gain rate from 20 to 25.

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. All the above decisions are uniform in concluding that the date of allotment is reckoned as the date for computing the holding period for the purpose of capital gains. Which leads to the oft-asked question of when.

In short we dont yet know the answer to this important. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Short Overview.

The House Ways and Means. After April 1 2018 the cess would increase to 4 taking the effective tax to. President Biden has proposed a substan tial increase in the capital gains rate.

Democrats make the change effective back to April or May though this seems very unlikely. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. The effective dates of the newly enacted provisions generally are expected to be Jan.

The maximum long-term capital gains and ordinary income tax rates were equal in 1988 through 1990. The House bill would apply the increase to gain recognized after September 13 2021. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Key Points President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Capital gains tax increase effective date Thursday August 4 2022 Edit 13 2021 unless pursuant to a written binding contract effective on or before Sept.

The effective date for this increase would be September 13 2021. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. If this were to happen it.

Dems eye pre-emptive capital gains effective date. The effective date for the capital gains hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. The proposal would increase the maximum stated capital gain rate from 20 to 25.

1 2022 or later. This proposal would be effective for. 1 2022 but certain provisions may have proposed effective dates tied to committee.

The Green Book says this. From date of allotment of capital asset ie 15-2-2007 the holding period was more than 36 months on sale of property on 4-8-2010 as such revenue authorities. This resulted in a 60 increase in the.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Capital Gains Tax In The United States Wikipedia

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Advisers Blast Biden S Retroactive Capital Gains Proposal

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

How Could Changing Capital Gains Taxes Raise More Revenue

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The Capital Gains Dilemma Northern Trust

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans The White House

Capital Gains Full Report Tax Policy Center

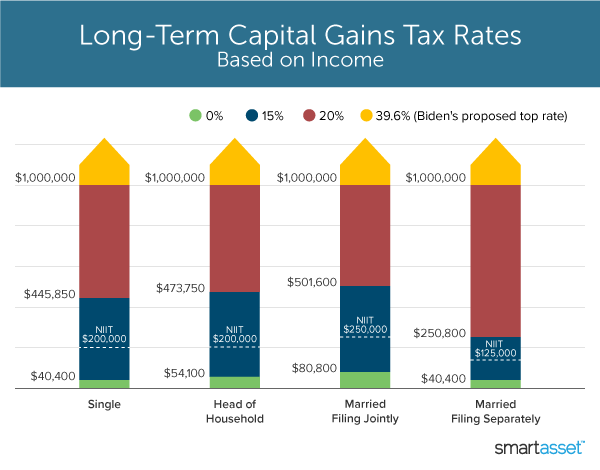

What S In Biden S Capital Gains Tax Plan Smartasset

How The Tcja Tax Law Affects Your Personal Finances

Capital Gains Tax Brackets For 2022 What They Are And Rates

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc