excise tax rate nc

Effective July 15 1986 the tax rate was changed to 14 cents per gallon plus. The NC use tax only applies to certain purchases.

How High Are Excise Tax Collections Where You Live Tax Foundation

The property is located in the City of Raleigh but not a.

. 1st and 2nd Quarter 2013 Gas-1200 Motor Fuels Claim for Refund Nonprofit Organizations. Tax Rates - Guilford County 2022-2023. 44th highest cigarette tax.

The North Carolina use tax is a special excise tax assessed on property purchased for use in North. In addition to the road tax every gallon of motor fuel includes a 0025 cents per gallon inspection tax. The tax rate is one dollar.

Imposition of excise tax. Property taxes become due each year on September 1 and must be paid by January 5 to avoid interest penalties andor collection proceedings. 1st and 2nd Quarter 2014 Gas-1200 Motor Fuels.

Imposition of excise tax. 2022 North Carolina state use tax. General Information Excise Tax is a state tax computed at the rate of 100 on each 50000 or fractional part thereof of the consideration or value of the interest conveyed.

The document has moved here. A single-family home with a value of 200000. North Carolinas excise tax on cigarettes is ranked 44 out of the 50 states.

Go to our Pay Taxes Online website to pay. The North Carolina cigarette tax of 045 is applied to every 20 cigarettes sold the size of an average pa See more. Customarily called excise tax or revenue stamps.

County Property Tax Rates for the Last Five Years. Excise tax is customarily paid by the. 1 2020 Information Who Must Apply Cig License.

Excise TaxRevenue Stamps. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is 5499 005499. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

County Property Tax Rates and Reappraisal Schedules. However if the person is getting the elderly exemption then the fee is only 28. Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax Motor Carrier Tax IFTAIN Privilege License Tax Motor Fuels Tax Alcoholic Beverages Tax.

For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. North Carolina has a 475 percent state sales tax rate a max local sales tax rate of 275 percent and an average combined state and local sales tax rate of 698 percent. The North Carolina excise tax on cigarettes is 045 per 20 cigarettes one of the lowest cigarettes taxes in the country.

When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday Sunday or Legal Holiday - April 12. The fee for a household mobile home or apartment is the same - 56. Iredell County Solid Waste Fee.

Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The tax rate is one dollar.

Free viewers are required for some of the attached documents. County and Municipal Property Tax Rates and Year of Most Recent Reappraisal. The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price.

Tax rates are applied against each 100 in value to calculate taxes due. This title insurance calculator will also. They can be downloaded by clicking on the icons below.

What Is The Gas Tax Rate Per Gallon In Your State Itep

Excise Tax Rates For Vapor Products In The States Americans For Tax Reform

State Excise Taxes For Distilled Spirits Bevology Blog Oh Pinions

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise Taxes Excise Tax Trends Tax Foundation

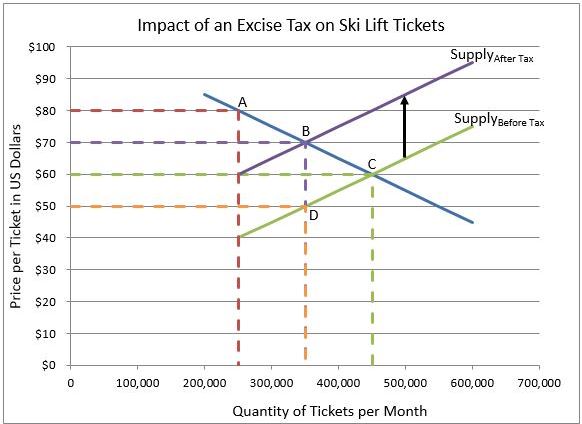

Definition Of An Excise Tax Higher Rock Education

State Alcohol Excise Tax Rates Tax Policy Center

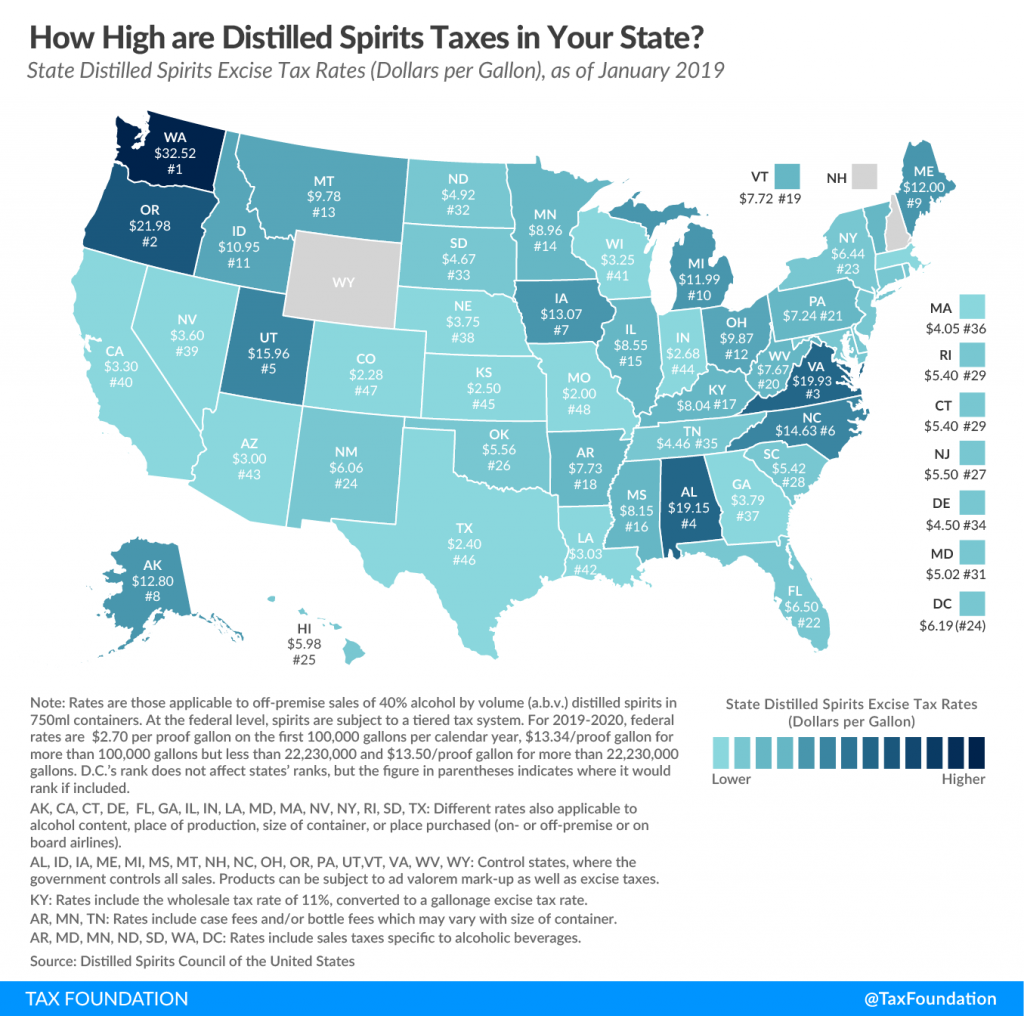

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

State Tax Levels In The United States Wikipedia

Motor Fuel Taxes Urban Institute

States With The Highest Lowest Tax Rates

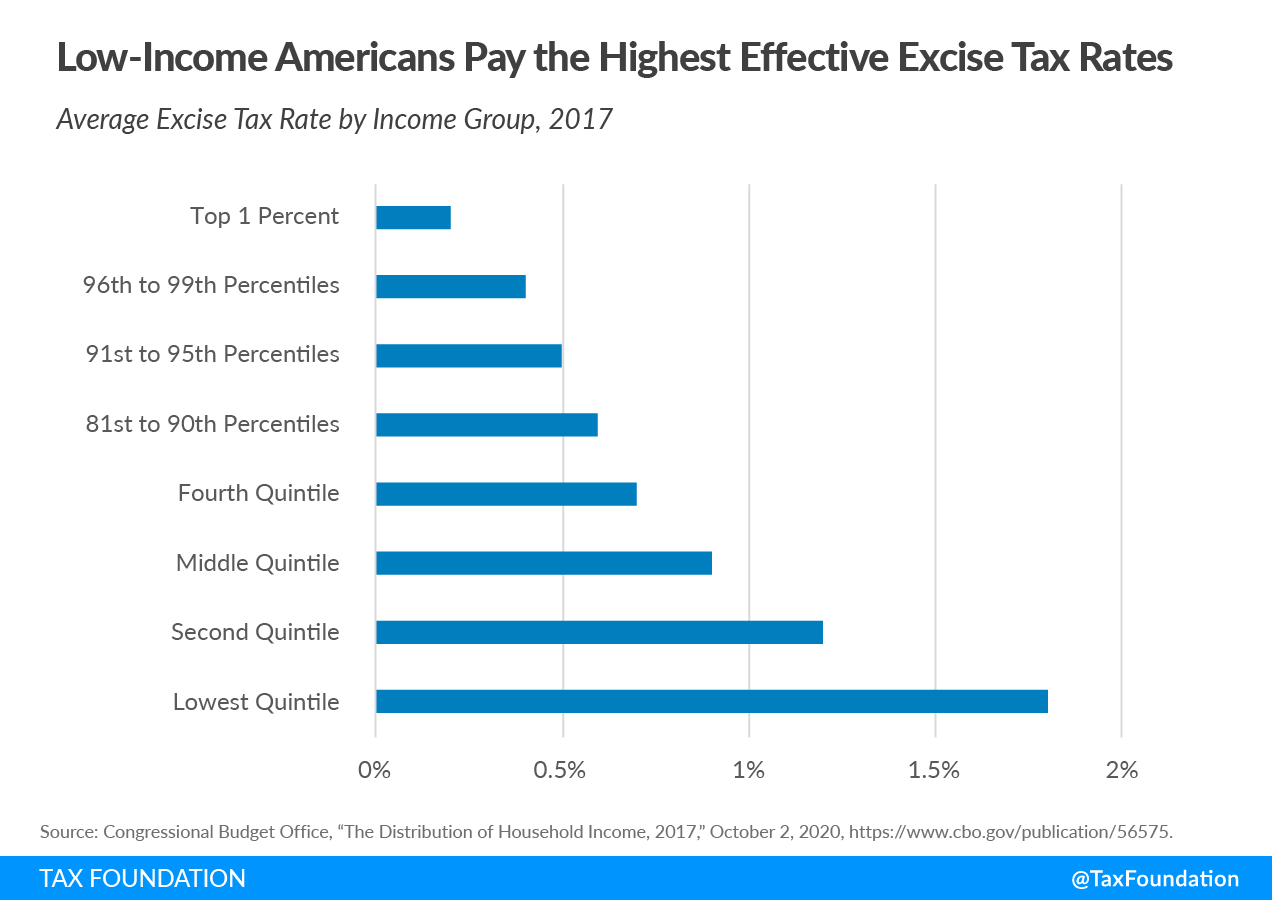

Excise Taxes Excise Tax Trends Tax Foundation

Excise Taxes Excise Tax Trends Tax Foundation

State Sales Tax Rates Sales Tax Institute

Historical North Carolina Tax Policy Information Ballotpedia

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara